부자 학교, 가난한 학교(Rich school, Poor school)

작성자 정보

- 푸른하늘 작성

- 작성일

컨텐츠 정보

- 6,703 조회

- 0 추천

- 목록

본문

지난 4월에 위니펙 프리 프레스 신문에 난 기사인데, 시간이 날 때 번역을 하려고 했는데...

시간만 자꾸 가네요. 사는 지역과 아이들 학교를 선택할 때 참고하시면 좋을 것 같습니다.

내용은 이곳 위니펙도 교육세(School Tax)와 관련하여 각 학군마다 여러 어려운점이 있습니다.

자세한 내용은 아래 기사를 읽어 보세요. 첨부한 댓글도 잘 읽어보시고요. ^^

출처 : Winnipeg Free Press 4월 5일 신문에서

Rich school, poor school

Is the luck of the draw any way to run an education system?

Nick Martin

5/04/2009 1:00 AM | Comments: 9

IS this how Manitoba should be funding its public school system?

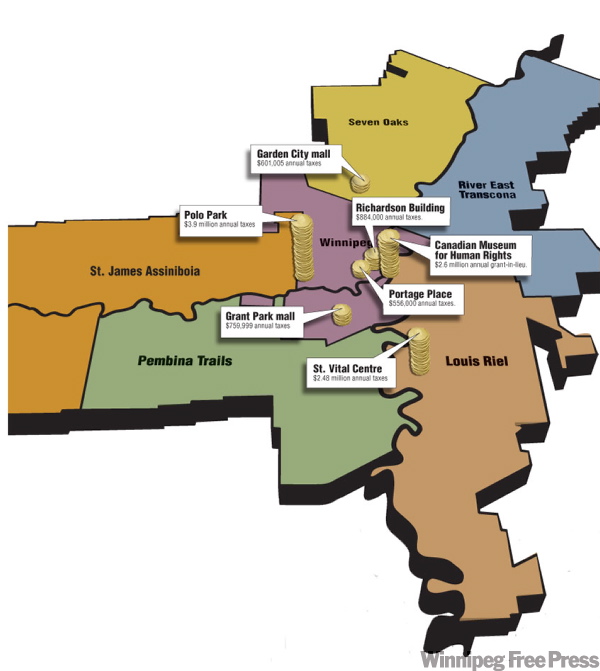

An IKEA store and shopping complex will open in three years on Kenaston Boulevard, serving shoppers expected to come from well beyond Manitoba, but every penny of as much as $2.14 million a year in education property taxes will go to Pembina Trails School Division.

Without adding a single student to that school division.

The Canadian Museum for Human Rights estimates its annual municipal tax bill -- actually a federal grant in lieu of taxes -- will be $5 million when it opens at The Forks, so about $2.6 million in education property taxes would go entirely to Winnipeg School Division.

From a national institution.

Which doesn't add a single student to the school division.

People complain about paying property taxes on their home to support the public school system, but commercial school property taxes are often even more bizarre, complex and inequitable, and play an enormous role in determining how much of the burden homeowners have to carry and how much money a school division has to spend on each child.

How can Seven Oaks School Division have Winnipeg's highest school taxes, yet spend per-student well below the provincial average, and spend per-student well below four of the city's lower-taxed divisions?

Well, for one thing, Seven Oaks has the city's smallest commercial assessment base, so homeowners carry far more of the burden of paying school taxes than do homeowners anywhere else in Winnipeg, who have the comparative luxury of malls, office towers and factories paying a big chunk of the local education bill.

Anomalies abound.

Polo Park customers and employees certainly come from a huge area, but every penny of its education property tax bill goes to WSD.

That's even though Polo Park does not add one single child to the school system and sits literally across the street from St. James-Assiniboia School Division.

But without the taxes from Polo Park, Portage Place, the downtown office towers and Grant Park Shopping Centre, WSD would have no hope of meeting the costly needs of so many special-needs children, at-risk students, kids of unemployed parents and single-parent families, refugees and immigrants and English-as-an-additional-language students.

Winnipeg School Division has Manitoba's third-highest property taxes, but the value of most of its homes is so low that suburban school divisions can draw on taxes generated by far higher average housing property values to educate each child, as can WSD.

"The funding formula needs a huge revamp, and the province has been reluctant to do that," said Seven Oaks school board chairwoman Claudia Sarbit.

Sarbit equates Seven Oaks' predicament to levying different provincial sales taxes dependent on the neighbourhood in which you live, or charging additional fees for health services in some parts of the city.

"It makes absolutely no sense," Sarbit said.

"Per-pupil spending, these gaps are huge. It shows up in the classroom," said Seven Oaks superintendent Brian O'Leary. "People in our division have been paying higher taxes than they should have for years.

"We're the leanest in terms of administration," O'Leary said. "In terms of paraprofessionals, we probably have half" the number the division needs.

"The distribution is unfair to taxpayers and unfair to kids," he said.

Homeowners make up 84.3 per cent of the assessment base in Seven Oaks, while homeowners are only 61.6 per cent of the assessment base in St. James-Assiniboia. That's why taxes on a $100,000 house are $229.50 higher in Seven Oaks than in St. James-Assiniboia, even though Seven Oaks spends $635 less per student than does St. James-Assiniboia.

Pembina Trails board chairwoman Jacquie Field said the division does not know how much education tax that IKEA will pay, or when the store or associated developments will first start paying taxes.

But a report to city council's executive policy committee suggests that, based on current mill rates, the IKEA complex could potentially pay Pembina Trails $2.14 million a year if all components get built.

"A windfall on top of a windfall," said O'Leary, whose division's Garden City mall pays only $601,005 a year to help beleaguered Seven Oaks homeowners carry the load.

"The disparities in assessment bases are huge," O'Leary said. Seven Oaks trustees want commercial assessment pooled and shared by every division equally on a per-student basis.

"We'll be the highest (city taxes) this year, and paradoxically, we'll spend considerably less than other divisions. It's not spending that's driving it," he said.

Shared commercial assessment is not going to happen.

"That is the lay of the land, where businesses locate" they pay their taxes, and that's not going to change, Education Minister Peter Bjornson said.

The lowest school taxes in Manitoba are in Gimli-based Evergreen School Division, where residents of Bjornson's provincial seat enjoy the benefits of industry, cottages and retirement condos taking the load of carrying school costs off homeowners.

"My home division has one of the highest assessment bases per student, for a low student population," Bjornson acknowledged.

No other division is remotely close to the $280,320 of assessed property value that Evergreen can draw on to produce taxes to educate each student -- the provincial average is $168,779, second is Virden-based Fort la Bosse at $232,520.

Manitoba's highest school taxes are in Thompson, where low property values and a lack of business and industry give Mystery Lake School Division only $78,340 of assessed property value for each child in school.

But Bjornson argued that the province uses equalization payments to cover off some of that difference in assessment bases. "We've certainly moved our feet on that every year with equalization," he said.

River East Transcona is almost in the same boat as Seven Oaks. The division has the lowest spending per student of any of the six city divisions, but has its third-highest taxes.

"We've always asked the province to review how they're doing assessment," River East Transcona school board chairman Bob Fraser said. "We'd like them to look at a different way of doing commercial assessment."

nick.martin@freepress.mb.ca

The homeowners' burden

Here's the percentage of homeowners which make up each city division's assessment base:

■Seven Oaks 84.3 per cent

■River East Transcona 80.2

■Louis Riel 79.1

■Pembina Trails 78.8

■St. James-Assiniboia 61.6

■Winnipeg 52.3

But consider also that the actual combined assessed value of homes in each of Pembina Trails, Louis Riel and River East Transcona are almost equal to the assessed value of homes in WSD -- from $2 to $2.2 billion, compared to WSD's $2.4 billion -- even though they each have roughly 40 to 50 per cent of Winnipeg SD's student population. Because so many homes in WSD have a much lower assessed value than suburban homes, their individual tax bills are much lower, and the dollars that homeowners produce in property taxes are far lower per student -- without commercial assessment, WSD could not possibly afford so many of its programs.

Look at the assessed value of property that divisions have to spend on each student.

For all its apparent riches in downtown business, Polo Park, and the homes of Crescentwood and River Heights, WSD has $159,763 in assessed property values to spend on each student, $9,000 a head below the provincial average.

Pembina Trails has $224,253, St. James-Assiniboia $222,547, Louis Riel $175,677, River East Transcona $151,644, and Seven Oaks a mere $137,631.

Let's put it another way. Let's look only at the property value of homes within the six largest city divisions and see how much assessed residential value per student that each division has, based on the latest available Sept. 30, 2007, provincial enrolment figures:

■Winnipeg $73,396

■Seven Oaks $112,795

■River East Transcona $117,165

■St. James-Assiniboia $130,323

■Louis Riel $150,802

■Pembina Trails $173,850

Some properties and what they pay in school taxes:

Kenaston Common in Pembina Trails pays $418,000.

Winnipeg S.D. gets $3.9 million a year from Polo Park, and St. Vital Centre pays $2.48 million annually to Louis Riel S.D. in school taxes.

Compare that to the $601,005 that Seven Oaks receives from Garden City mall.

But wait, the news gets worse for Seven Oaks -- Grant Park mall also pays WSD $759,999 and Portage Place $556,000.

Stand on the roof at Grant Park mall and you can see Pembina Trails S.D., but like Polo Park, every penny stays in Winnipeg SD regardless how close it sits to a neighbouring division and no matter where its customers live.

Having the Regent Avenue casino in its midst scores River East Transcona School division $701,000 a year.

Hands up anyone who doesn't believe that IKEA will draw customers from all over Manitoba -- not to mention neighbouring provinces and states.

That would pump $2.14 million of education property taxes a year solely into the delighted coffers of Pembina Trails SD.

In 2008-2009, every homeowner and business property owner in all of Pembina Trails paid a total of $67.9 million in education property taxes -- talk about a bonanza.

The Richardson building pays about $884,000 to WSD.

The University of Manitoba would be paying $2.95 million a year to Pembina Trails -- would be, had not the Doer government exempted universities and colleges several years ago. The University of Winnipeg's new science complex just by itself would have been worth $634,000 a year to WSD.

How do we know a property's tax bill?

First, go to the City of Winnipeg assessment department website's property details page.

You have to know the street address of the property. Once you click, that will give you the assessed value of the property.

Take that figure to the city's tax calculator, plug in the number, choose the type of property category (residential, commercial, institutional, etc.) and then choose the school division in which it's located.

Click and you get the property's tax bill.

Rate this We want you to tell us what you think of our articles. If the story moves you, compels you to act or tells you something you didn’t know, mark it high. If you thought it was well written, do the same. If it doesn’t meet your standards, mark it accordingly.

You can also register and/or login to the site and join the conversation by leaving a comment.This article is currently rated an average of 4.7 out of 5 (7 votes).Rate it yourself below by rolling over the stars and clicking when you reach your desired rating. We want you to tell us what you think of our articles. If the story moves you, compels you to act or tells you something you didn’t know, mark it high.

This article was first published on winnipegfreepress.com on Saturday, April 4, 2009. It was last updated at 12:30 PM on April 7, 2009. This is because there was a spelling mistake.

9 CommentsPosted by:Last Air Ranger

April 11, 2009 at 12:03 AM

my father was legal counsel for about 40 years prior to his retirement in 1963. i remember him remarking to me that amending the public schools act was a very painful and lengthy process even then, so i suspect the process has not improved. i suggest that anyone wishing to change things contact their MLA, school board, and keep doing so as it is so easy just to

sweep this under the rug. keep up the pressure. he was of course counsel to WSD 1.

Report abusive comment Posted by:Tired Of The BS

April 8, 2009 at 7:15 PM

They whole system stinks. Our so called Mayor wants to spend tax payers money on BS....We live in a City with a very high crime rate and have a Very Big Poverty Issue within this province. The Rich keep getting Richer and the Poor keep suffering. Is it not time we start to change things for the better and stop all this building and concentrate on what is going to happen to tomorrows children. Manitoba may still be a cheaper place to live but the spending of Government and City Council keeps hiking the pocket books for all.

Report abusive comment Posted by:MyEyeIsOnYou

April 6, 2009 at 12:45 AM

The commercial assessment issue is pretty much standard across Canada and the USA...doesn't mean it is fair, that's the way it is done. Could be changed or tinkered with. Some states have a Robin Hood policy, the district keeps the first, say, $200,000 assessment per student, with an adjustment for special needs, etc., and the rest is pooled and then shared out again. There's a thousand ways to do it and none of them are fair to everyone. If you think Pemvbina Trails is getting such a great deal, move there.

Report abusive comment Posted by:Steve

April 6, 2009 at 12:35 AM

Great article on our school divisions and the taxation system. It is still hard to beleave that we still require six separate school divisions? The current system certainly doesn't serve our students and/or our tax system. I beleave there is a need to eliminate all this duplication and unnecessary bureaucracy by amalgamating them. There are a number of other cities/prov. across Canada that have been moving forward, yet Wpg/MB has not.

Our Gov't needs to step up to the plate and take a stand on this issue as well as the school busing rules/guidelines.

There has to be a lot of $ savings by eliminating the majority of duplication, which in turn could be used to improve our schools as well as maintaining and/or reducing the current school tax rates.

Report abusive comment Posted by:cougar222

April 5, 2009 at 8:50 PM

I agreed with MikeyT except for one thing: The NDP is not capable of taking a bold stand on anything.

Report abusive comment Posted by:double nickel

April 5, 2009 at 7:44 PM

Artobloom is right on.

Report abusive comment Posted by:Charlene

April 5, 2009 at 6:00 PM

Why not apportion school tax out by the number of students in each division?

Report abusive comment Posted by:MikeyT

April 5, 2009 at 9:53 AM

Great article outlining the irrational nature of our school division taxation system. Why does a city of 600,000+ even require six separate school divisions? This system certainly doesn't serve our students any better and, as pointed out in the article, our taxpayers either. We need to eliminate all this duplicated and unnecessary bureaucracy by amalgamating the school divisions. What do other cities of our size do across Canada? I know at least one much larger city (Vancouver) manages just fine with one school division. The provincial government needs to take a bold stand on this issue once and for all, beyond the tinkering done several years back with a few amalgamations.

Report abusive comment Posted by:Artobloom

April 5, 2009 at 7:50 AM

I believe the goal of our education minister and our ndp government is to bankrupt our school divisions so that they can take control of them. That way they can tell the all the school divisions to teach what they want taught and how. Thus the local people will no longer have a say in how their schools are run. The gov't is doing this by limiting the amount of tax increases, by not allowing them to close schools that need to close because of small class sizes.

This story is just the start, just like the last school board election where one candidate wanted one big school division.